Follow Us :

Water Chillers Market Report: Size, Share, Trends, and Forecast (2024-2033) – By Type, Capacity, and End-user Industry

- Report ID: STAR8124

- Industry: Manufacturing & Industrial

- Published Date: 16-10-2024

- NUMBER OF PAGES: 237

- FORMAT:

Water Chillers Market Research: 2033

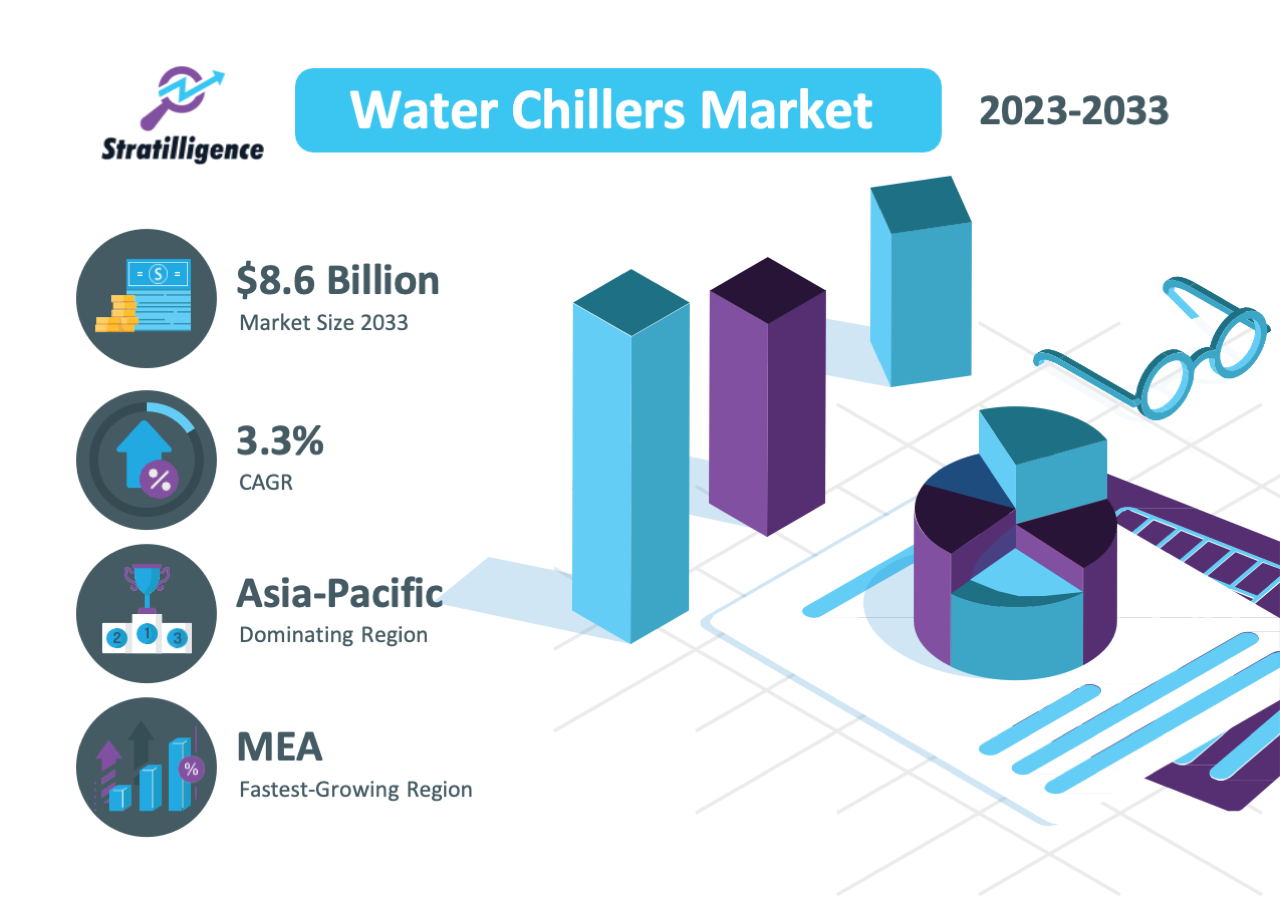

The global water chillers market was valued at $6.2 billion in 2023 and is projected to reach $8.6 billion by 2033, growing at a CAGR of 3.3% from 2024 to 2033. A water chiller refers to a refrigeration system that cools water for various industrial and commercial applications. They delete the heat from the water using a refrigeration cycle, similar to a household refrigerator scaled to a larger size. For effective working and cooling, water chillers often operate.

Water chiller devices are potentially applied in large buildings such as hospitals, hotels, malls, and industrial facilities to maintain an optimal operating temperature suitable for air conditioning. Additionally, it could further be applied during manufacturing processes to cool machinery, control product temperatures, and enhance chemical reactions. The varied types of water systems include the air-cooled and water-cooled systems. The air-cooled system rejects the heat externally to the ambient air, while the water-cooled chiller discards the rejected heat to a separate water loop. The heat is further transformed, and air or water-cooled is commonly used.

Key Market Drivers and Growth Factors in the Water Chillers Market

The major advantage of water chillers is their ability to efficiently cool large volumes of water destined for commercial and industrial applications. Water chiller, in contrast to other cooling techniques, delivers a consistent and uniform temperature control range throughout various operating circumstances. This function is useful since many industrial and commercial applications require precise temperature control to achieve. Manufacturing processes, large building HVAC systems, Data centers, and medical facilities are just a few specific uses. Such factor drives the water chillers market.

Moreover, water chillers are more energy-efficient than air-based cooling systems, particularly water-cooled chillers that leverage lower ambient temperatures or natural sources of water for cooling. Over the long term, the above-mentioned energy efficiency can result in cost savings in terms of reduced energy and other operating expenses. Finally, water chillers can be tailored to suit any need. For example, it is possible to design them to meet cooling requirements, in order to cool equipment, processes, or even entire buildings. Other options for integrating chillers into existing infrastructure, customized variants, or simply a restricted amount of space – whatever it is, can be adapted to chillers. Such a factor propels the water chillers market.

The use of water chillers is closely connected to the requirements of industries and commercial sectors that need temperature regulation, for their operations, machinery, and buildings. Sectors like manufacturing, pharmaceuticals, food and beverage data centers, and building HVAC systems play a role in creating demand for water chillers. Technological advancements, such as enhancements in compressor efficiency heat exchanger design and control mechanisms, foster innovation in the water chiller sector.

These progressions result in energy-dependable and cost-effective chillers thereby boosting water chillers market expansion. The rise in regulations focused on curbing greenhouse gas emissions and enhancing energy efficiency encourages the adoption of eco refrigerants and energy-efficient technologies in water chillers. Adherence, to guidelines and sustainability efforts, can shape product advancements and water chiller market trends.

Urbanization and the expansion of areas, in developing countries are creating opportunities for the water chiller sector. The development of buildings, industrial sites, and infrastructure projects frequently necessitates HVAC systems and cooling solutions, which in turn fuel water chillers market growth. Industries like pharmaceuticals, biotechnology, and electronics manufacturing have strict temperature control needs to uphold product quality and safety. This demand for dependable temperature regulation spurs the water chillers market tailored to meet these specifications.

The replacement of water chiller systems and the modernization of existing infrastructure with energy-efficient and technologically advanced equipment are key drivers of water chiller market expansion. End users often aim to enhance efficiency, lower operating expenses, and adhere to evolving requirements through investments, in newer chiller technologies.

The water chillers market is influenced by economic factors such as GDP growth, industrial output, and consumer spending. The natural patterns of economic expansion usually strengthen construction projects, industrial production, and infrastructure development, which in turn spike demand for cooling solutions. Consequently, economic prosperity elevates consumer spending, increasing demand for commercial establishments, including shopping malls, hotels, restaurants, and office buildings. All these establishments use efficient HVAC systems, including water chillers, to provide the best comfort to their occupants and to protect sensitive equipment and materials. Economic expansion implies more industrial production and manufacturing activities, which in turn positively impact the water chillers market.

Most of industries use water chillers in their processes and equipment to maintain desired temperatures. As industrial output and production increase, demand for a number of water chillers also grows. Any economic expansion also propels an increase in construction including residential, commercial, and industrial buildings. While new buildings are constructed and old ones go through renovation and expansion, the demand for HVAC systems, including water chillers, to provide the cooling of structures simultaneously increases.

Coverage of the report

| Scope | Details |

|---|---|

| Market Size Estimation | Quantitative Insights: Market size and projections from 2019 to 2033, Market Size Units: USD Billion |

| Market Dynamics | Analysis of drivers, restraints, and trends shaping the market |

| Industry Analysis | Value chain analysis, Profit margin analysis, and Industry Overview |

| Segmentation | Type (Screw Chiller, Scroll Chiller, Centrifugal Chiller, Absorption Chiller, Reciprocating Chiller, Others), by Capacity (0-100 kW, 101-350 kW, 351-700 kW, >700 kW), by End-user Industry (Chemicals and Petrochemicals, Food and Beverage, Plastics and Rubber, Healthcare, Others) |

| Region Insights | Detailed analysis for North America, Europe, Asia-Pacific, Latin America, MEA with key countries in each region |

| Competitive Analysis | Company profiles, Ranking/Market share analysis, Competitive structure, Product differentiation |

| Customer Landscape Analysis | In-depth understanding of customer industry, preferences, and buying patterns |

| Supplier Analysis | Comprehensive analysis of suppliers |

Key Benefits for Stakeholders

This comprehensive report provides stakeholders with in-depth qualitative and quantitative analyses, focusing on the global water chillers market from 2023 to 2033.

Key benefits include:

- Insightful Market Forecast: The report offers detailed projections, covering various segments, current trends, and market dynamics.

- Competitive Analysis with Porter’s Five Forces: A thorough examination of the bargaining power of buyers and suppliers, the threat of new entrants, competitive rivalry, and substitute products.

- Comprehensive Market Overview: Gain access to crucial information about key market drivers, restraints, and opportunities.

- Regional and Country-Level Mapping: The report maps out major regions and countries based on their revenue contribution to the global water chillers market.

- Market Player Positioning: The competitive landscape analysis provides a clear understanding of the current market positioning of key players.

Challenges and Restraints in the Water Chillers Market

The water chillers are known for saving on energy relative to alternatives, they still rely on refrigerants, which can leak or seep into the atmosphere if not handled properly. Additionally, regulations about pressure and refrigerant phase-out are changing. This can result in expensive necessary upgrades, which are costly, time-consuming, and labor-intensive in many cases. Such factors may restrain the water chillers market growth.

Opportunities in the Water Chillers Market

Modern water chillers use cutting-edge technology that is constantly improving. Some of the most important components of water chillers – heat exchangers, control systems, and especially variable speed compressors – have all seen extraordinary advances in recent years. For example, specially designed heat exchanger surfaces and grooves increase the heat transfer rate of water chillers to achieve high Coefficient of Performance (COP) levels. Additionally, variable-speed compressors consume a fraction of the energy that a traditional compressor requires to operate.

Most water chillers use innovative control systems that provide real-time data and allow the user to adjust the operation of the chiller from any location. These systems often come with algorithms that decide when to turn the system on or off, depending on the availability of renewable energy in a given time slot. They can also feature numerous types of adaptive control strategies.

Many water chillers use heat recovery systems that capture the thermal energy that the chiller generates as it produces cold water, a byproduct that can be reused as a heating energy source for either domestic hot water production or space heating. In this way, a water chiller’s energy efficiency is significantly improved, ultimately leading to a reduction in its running costs. Such factor offers lucrative growth opportunities for the water chillers market during the forecast period.

Water Chillers Market Segmentation

The water chillers market is bifurcated based on type, capacity, and end-user industry. By type, it is sub-segmented as screw chiller, scroll chiller, centrifugal chiller, absorption chiller, reciprocating chiller, and others. By capacity, it is bifurcated as 0-100 kW, 101-350 kW, 351-700 kW, >700 kW. By end-user industry, it is sub-segmented as chemicals and petrochemicals, food and beverage, plastics and rubber, healthcare, and others.

In 2023, screw chiller segment registered the highest revenue in 2023, owing to its advantages features such as energy efficiency, minimal maintenance, reliability, durability, capacity control, etc. Similarly, the chemicals & petrochemicals segment registered the highest revenue in 2023.

Regional Analysis of the Global Water Chillers Market

Region-wise, the water chillers market analysis is conducted across North America (the U.S. and Canada), Europe (UK, France, Germany, Italy, and Rest of Europe), Asia-Pacific (China, Japan, India, South Korea, and Rest of Asia-Pacific), and Latin America (Brazil, Mexico, Argentina, and Rest of Latin America), and MEA (Saudi Arabia, UAE, South Africa, and Rest of Middle East & Africa).

Competition Analysis

The major players profiled in the report having significant water chillers market included are Atlas Copco Ltd., Carrier Global Corporation, Daikin Industries Ltd., Dimplex Thermal Solutions, Johnson Controls International PLC, LG Electronics, Midea Group Co., Ltd., Mitsubishi Electric Corporation, Thermax Limited, and Trane Technologies plc.

Key Developments/ Strategies in the Water Chillers Market

Major companies in the water chillers market have adopted product launches, partnerships, business expansion, and acquisition as their key developmental strategies to offer better products and services to customers in the market, which is contributing to the water chillers market growth.

- In January 2023, U.S.-based Atlas Copco Compressors LLC launched a TCA water chiller with four configurations. The four-model offers cooling capacities from 55 to 228 kW with unique features designed for optimum energy efficiency and complete operational safety.

- In February 2023, Malaysia-based Dunham-Bush launched a new generation of Hyperion series water-cooled screw chiller. Its features include single/twin compressors with independent circuits, inverter screw compressors with superior part-load performance, and power supply.

- In September 2022, Germany-based ENGIE Refrigeration GmbH developed SPECTRUM water chiller. Its features include an oil-free, high-lift turbo compressor, and sustainable refrigerant with a rated refrigeration capacity of 170 to 1,100 kilowatts.

To explore the complete range of topics and critical insights our report offers, including comprehensive chapter names and pivotal sections, we invite you to submit a request for a detailed sample. Your inquiry will help gain an in-depth perspective on the report’s valuable content.

Chapter 1: Executive Summary

-

- Overview of the report

- Key findings and insights

- Market Entry Strategy (Add-on)

- Strategic Recommendation

Chapter 2: Introduction

Chapter 3: Market Overview

Chapter 4: Water Chillers Market, by Type

Chapter 5: Water Chillers Market, by Capacity

Chapter 6: Water Chillers Market, by End-user Industry

Chapter 7: Water Chillers Market, by Region

Chapter 8: Water Chillers Market, by Country

Chapter 9: Customer Industry Analysis (Add-on)

-

- Price Sensitivity Analysis

- Purchase Criteria Analysis

- XX

- XX

- XX

- XX

- XX

- XX

- XX

- XX

- XX

Chapter 10: Suppliers Analysis (Add-on)

-

- Industry Structure Analysis

- Switching Cost Analysis

- XX

- XX

- XX

- XX

- XX

Chapter 11: Competitive Landscape

Chapter 12: Company Profiles